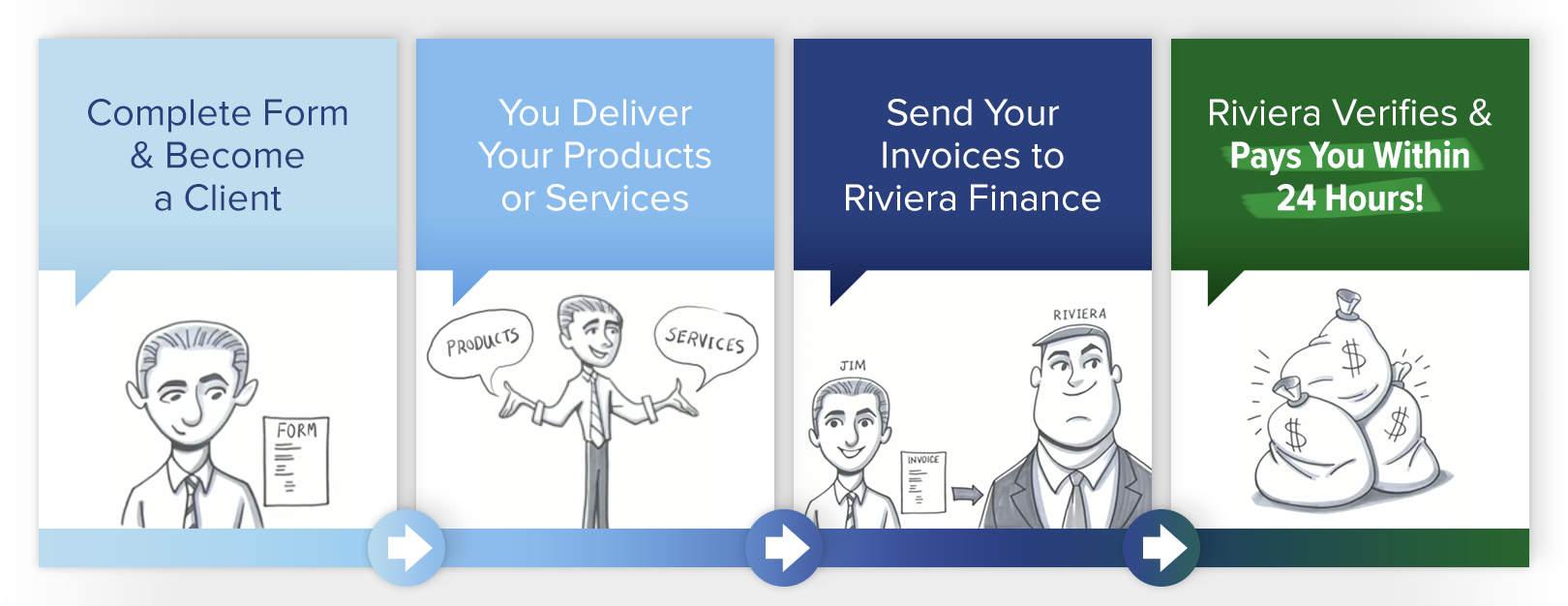

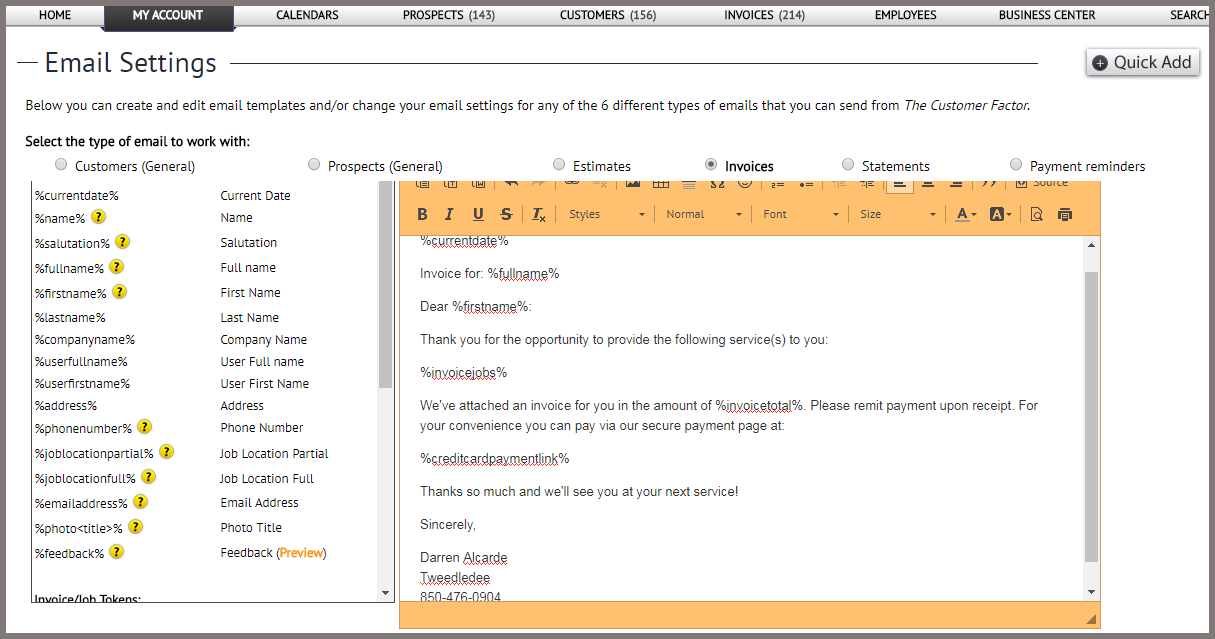

They will then buy your invoice from you and pay you immediate funds for the invoice. You are submitting invoices from your clients to an invoice factoring company. Invoice factoring also goes by the name accounts receivable factoring.ĭespite what you call business invoice factoring, the process is the same. Does Your Company Qualify for Business Invoice Factoring?įirst of all, in order to determine if your business qualifies for business invoice factoring, you need to understand what invoice factoring truly is. In times when cash flow is low and your business finds itself waiting a long period of time to receive payments from your clients, you can simply factor invoices and receive the funds immediately. The factoring agent will then provide the funds on the invoice to the business. This agent will take the information on the invoice and run the client’s credit history to assure that this client will pay for the services requested. The seller basically sells one of their company’s invoices to the invoice factoring agent. First, there is the party that sells the receivable, which is normally the business owner, the debtor, which is normally the client who owes the money indicated on the invoice, and the factor, otherwise known as the invoice factoring company. There are three parties involved in invoice factoring. Therefore, allowing the business to have a sufficient amount of cash to cover any financial obligations that they may have.īasic Information About Invoice Factoring The invoice factoring company will then supply cash to the business for the invoice that was sold. Invoice factoring is helping many businesses remain afloat and allow businesses to keep their doors open, despite our shrinking economy.įactoring is the process whereby a business sells its account receivables at a discounted rate to an invoice factoring company. The good news is there are alternatives that business owners can take advantage of to help them during these tough economic times. Banks and other private lenders are decreasing the amount of money they lend out, in order to keep their own business afloat. Many businesses are finding it impossible to obtain any funds from any lending institutions. There are a plethora of people that are being forced to downsize their businesses simply because they do not have a sufficient cash flow that they can depend on to run their business. Many small and medium sized businesses are having an increasingly hard time with the strain of the economic crisis. Why Business Invoice Factoring is Better Than Taking Out a Business Loanīusiness Invoice Factoring May Be Helpful in These Tough Economic Times.Business Invoice Factoring versus Purchase Order Financing.When Is It the Right Time to Obtain Business Invoice Factoring?.Does Your Company Qualify for Business Invoice Factoring?.Business Invoice Factoring May Be Helpful in These Tough Economic Times.When compared with traditional credit-based loans, which can take extended periods of time to obtain and can affect your credit, asset-based lending can be the better choice for small and mid-sized companies in need of a quick cash solution. In most instances, a company can receive up to eighty to ninety percent of the value of their assets in cash, quickly and efficiently. With this type of lending, your company receives a cash advance based on the value of your assets and the creditworthiness of your customers. If this is happening with your company, then you may be an ideal candidate for asset-based lending, finance factoring or purchase order financing. This is because it is very probable to become a company that is rich in assets but not in cash, due to outstanding invoices from your customers. Unfortunately, even the most established businesses may have difficulty maintaining and generating the cash they need to take care of the day to day demands, such as manufacturing and payroll. For every company, it is important to have a consistent flow of capital in order to stay competitive and vital in the business world.

0 kommentar(er)

0 kommentar(er)